Charity can be sweet, but scammers turn it sour. Here’s how to determine if the charity you’re considering giving to is legitimate.

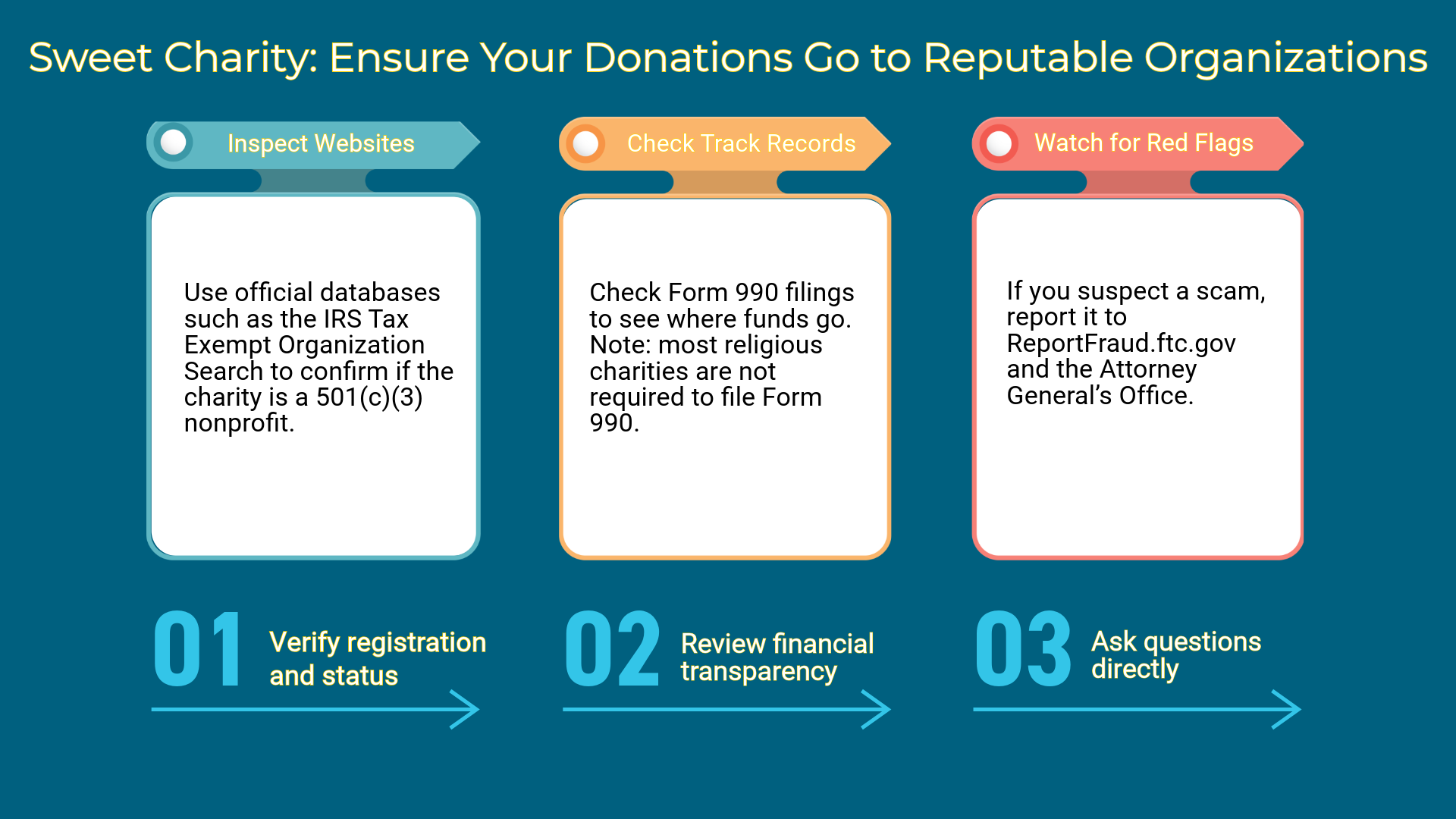

Verify registration and status

- Use official databases:

- IRS Tax Exempt Organization Search – confirms if it’s a 501(c)(3) nonprofit.

https://apps.irs.gov/app/eos/ - Charity Navigator, Candid (formerly GuideStar), and BBB Wise Giving Alliance all provide charity ratings, financial info, and legitimacy details.

- IRS Tax Exempt Organization Search – confirms if it’s a 501(c)(3) nonprofit.

- Check with your state charity regulator (in Nebraska, that’s the Nebraska Attorney General’s Office).

Review financial transparency

- Legitimate charities publish:

- Annual reports and Form 990 filings (available via Candid/GuideStar). Note: Most religious charities are not required to file Form 990. For more information: Filing Requirements for churches and religious organizations | Internal Revenue Service

- Clear details on how donations are spent — e.g., programs vs. administration.

- Be skeptical of groups that can’t show where money goes.

Watch for solicitation red flags

- Pressure tactics (“Donate now or people will suffer!”).

- Unclear or generic names resembling well-known charities (e.g., “Red Cross Relief Fund” instead of “American Red Cross”).

- Requests for cash, gift cards, cryptocurrency, or wire transfers — all red flags.

- Untraceable contact info — no physical address, official website, or verifiable phone number.

Inspect the website and email

- Verify the URL ends in .org (not .com, .net, or misspellings).

- Look for:

- Secure connection (https://)

- Legitimate contact information

- No spelling errors or generic images

- Avoid links sent in unsolicited messages or social media DMs.

Research their track record

- Search the charity’s name + “scam,” “complaint,” or “reviews.”

- See if media outlets or watchdogs have investigated them.

- Confirm their mission, leadership, and impact reports are publicly available.

Ask questions directly

A legitimate charity should answer:

- “How is my donation used?”

- “Are you registered with the IRS?”

- “Can I see your financial report or 990 form?”

If they refuse or get defensive — that’s a warning sign.

If you suspect a scam

- Report it to:

- FTC: ReportFraud.ftc.gov

- Better Business Bureau (BBB): bbb.org/scamtracker

- Attorney General’s Office